mediacomponent.ru Prices

Prices

Mutual Funds Versus Stocks

Both ETFs and Mutual Funds offer a way for investors to pool money into a fund that make investments in a collection of stocks, bonds, or other assets. ETFs trade like stocks and are listed on stock exchanges and sold by broker-dealers. Mutual funds, on the other hand, are not listed on stock exchanges and can. Learn how to decide between mutual funds, ETFs, and individual securities, and see how to narrow your options down. As you can see, each type of investment has its own potential rewards and risks. Stocks offer an opportunity for higher long-term returns compared with bonds. Mutual funds, on the other hand, are not traded on an exchange. Instead, they are bought and sold directly through the mutual fund company or through a broker. For instance, mutual funds are perfect if you want to hold onto the investment for 5 years. Further, stocks are less liquid than mutual funds since they cannot. Differences between ETFs & mutual funds An ETF could be more suitable for you. You can buy an ETF for the price of 1 share—commonly referred to as the ETF's. Both shares and mutual funds represent investment opportunities, they require a different approach for the same. Beside the steps of investing in them. Mutual funds provide diversification, professional management, and tax benefits, making them a better choice for many investors. Both ETFs and Mutual Funds offer a way for investors to pool money into a fund that make investments in a collection of stocks, bonds, or other assets. ETFs trade like stocks and are listed on stock exchanges and sold by broker-dealers. Mutual funds, on the other hand, are not listed on stock exchanges and can. Learn how to decide between mutual funds, ETFs, and individual securities, and see how to narrow your options down. As you can see, each type of investment has its own potential rewards and risks. Stocks offer an opportunity for higher long-term returns compared with bonds. Mutual funds, on the other hand, are not traded on an exchange. Instead, they are bought and sold directly through the mutual fund company or through a broker. For instance, mutual funds are perfect if you want to hold onto the investment for 5 years. Further, stocks are less liquid than mutual funds since they cannot. Differences between ETFs & mutual funds An ETF could be more suitable for you. You can buy an ETF for the price of 1 share—commonly referred to as the ETF's. Both shares and mutual funds represent investment opportunities, they require a different approach for the same. Beside the steps of investing in them. Mutual funds provide diversification, professional management, and tax benefits, making them a better choice for many investors.

The decision between investing in mutual funds versus stocks depends on several factors, including an individual's investment goals, risk tolerance and. Mutual funds and stocks both have their pros and cons, and the best investment option for you will depend on your personal financial goals, risk tolerance, and. The decision between investing in mutual funds versus stocks depends on several factors, including an individual's investment goals, risk tolerance and. Mutual funds and stocks both have their pros and cons, and the best investment option for you will depend on your personal financial goals, risk tolerance, and. ETFs vs. Mutual Funds vs. Stocks ; ETFs diversify risk by creating a portfolio that can span multiple asset classes, sectors, industries, and security. Single Stocks vs Mutual Funds · The opposite of the diversification issue: If you own just one stock and it doubles, you are up %. · If you hold your stocks. ETFs often generate fewer capital gains for investors than mutual funds. This is partly because so many of them are passively managed and don't change their. Mutual funds are groups of stocks. When you buy a share in a mutual fund you get a tiny fraction of each stock in the fund giving you better diversification. Average net expense ratio for ETFs vs. active mutual funds* · Lower cost: ETFs, many of which are passively managed, offer lower fees than active mutual funds. To answer about fees, stocks have no fees anymore to purchase nor are there expense ratios. Mutual funds (or ETFs) will mostly have underlying. Differences · 1. ETFs are traded on stock exchanges, while mutual funds are not. · 2. ETFs typically have lower fees than mutual funds. · 3. ETFs can be bought and. When you buy shares of a fund, you become a part owner of the fund, and you share in its profits. For example, when the fund's underlying stocks or bonds pay. Mutual funds usually offer better diversification compared to equity investments. Mutual fund companies pool money from multiple investors to invest in a. When you buy a share in a fund, you're really buying a piece of a large, diverse portfolio. Conversely, stocks are shares of a single company. Stocks vs. Funds. The difference of course is that ETFs are "exchange traded." That means you can buy and sell them intraday, like any other stock. By contrast, you can only buy. ETFs trade like stocks and are listed on stock exchanges and sold by broker-dealers. Mutual funds, on the other hand, are not listed on stock exchanges and can. Index funds and mutual funds both pool investors' money to buy many different securities, but index funds use a passive investment strategy. The key difference between individual stocks and a mutual fund is investing in a single company versus investing in a collection. With stocks, you are putting. When an investor buys a stock, part ownership in the form of a share is bought. · Bonds are a type of investment designed to aid governments and corporations to.

Credit Cards And Scammers

5 Debit and Credit Card Scams and How to Avoid Them · 1. The Promise of Lower Interest Rates. In this scam, tricksters try to appeal to consumers with promises. Types of credit card fraud · Phishing. In a phishing attack, fraudsters send emails or texts posing as a legitimate institution like a bank, credit card company. Two of the most common types of credit card fraud are skimming and card cloning. Be sure you know how to recognize the warning signs of each scam. If you or a. Consumer Alerts - Scams - Credit Card Company Warns of New Card Reader Scam Targeting. Thus, only those who swiped their cards were at risk of having their. While this scam has been around for several years, skimming is still a common method of credit card fraud. Skimming occurs at point of sale (POS) systems where. Credit card fraud is a form of identity theft that involves an unauthorized taking of another's credit card information for the purpose of charging. No, but you have to be responsible in using them properly. Make sure you understand all the fees and charges that are associated with your card. New account scams accounted for 89% (,) of credit card fraud complaints in , down from 91% (,) in Existing account fraud encompasses theft. Some criminals use lost or stolen credit cards to commit fraud. Others make illegal transactions without ever having the credit card in their possession. 5 Debit and Credit Card Scams and How to Avoid Them · 1. The Promise of Lower Interest Rates. In this scam, tricksters try to appeal to consumers with promises. Types of credit card fraud · Phishing. In a phishing attack, fraudsters send emails or texts posing as a legitimate institution like a bank, credit card company. Two of the most common types of credit card fraud are skimming and card cloning. Be sure you know how to recognize the warning signs of each scam. If you or a. Consumer Alerts - Scams - Credit Card Company Warns of New Card Reader Scam Targeting. Thus, only those who swiped their cards were at risk of having their. While this scam has been around for several years, skimming is still a common method of credit card fraud. Skimming occurs at point of sale (POS) systems where. Credit card fraud is a form of identity theft that involves an unauthorized taking of another's credit card information for the purpose of charging. No, but you have to be responsible in using them properly. Make sure you understand all the fees and charges that are associated with your card. New account scams accounted for 89% (,) of credit card fraud complaints in , down from 91% (,) in Existing account fraud encompasses theft. Some criminals use lost or stolen credit cards to commit fraud. Others make illegal transactions without ever having the credit card in their possession.

Report Fraud. If you spot a scam to lower your credit card interest rate or have information about a company or scammer who called you, report it at ReportFraud. Fraudsters, scammers, and cybercriminals are almost always in it for the money. That's why credit card fraud is so popular; it's one of the easiest ways to. What can scammers do with stolen credit cards? Credit card fraud broadly falls into card-present and card-not-present (CNP) scams. Of these, CNP scams are. Types of credit card fraud · Phishing and smishing scams. Phishing involves sending fraudulent emails to trick victims into clicking a link that will expose. For most types of scams, you should first visit the Action Fraud website. But if a scam is putting you or someone else in immediate danger, call the police. Credit card fraud happens when scammers use stolen or copied credit cards. Find out how to protect yourself. Secured Vs. Unsecured Cards · Deceptive Ads and Scams · How to Avoid the Scam · Credit Reporting · For More Information · $h2. scammers with regulations that make the card credit cards are continuously advancing, adding barriers for fraudsters attempting to steal money. With skepticism, education and vigilance. you can protect yourself from credit card scams and fraud. Credit Scam Phone Lock. EBT Phishing Scams · Phishing involves emails designed to get victims' personally identifiable information or financial credentials. Scammers typically pose as a. Credit card fraud has been around since the invention of credit cards themselves. These days, scammers are using a variety of tactics to obtain users' credit. In an interest rate deduction scam, fraudsters pose as customer service representatives from well-known lenders and credit card issuers. The scammers contact. NEVER answer questions to someone who called YOU. You know what bank or credit card company it is. Hang up, get the actual phone number and call. Counterfeiting. Also called “account takeover” or “new account fraud,” this type of fraud is the most invasive. Scammers obtain so much of your information. Phishing scams. A phishing scam is a type of wire fraud where scammers pretend to be a reputable business, according to the FTC. They target people through text. Credit card fraud occurs when an unauthorized person gains access to your information and uses it to make purchases. Here are some ways fraudsters get your. What To Do if You Were Scammed · If You Gave a Scammer Your Personal Information · If a Scammer Has Access to Your Computer or Phone · Report a Scam to the FTC. "Card Cracking" Scams Banks and law enforcement are cracking down on an emerging scam known as “card cracking.” Card cracking is a form of fraud where. Card-not-present (CNP) fraud. Scammers steal a cardholder's credit card and personal information — and then use it to make purchases online or by phone. · Credit. Phishing Scams. Like the name suggests, a phishing scam involves fraudsters phishing for your personal information. Scammers contact their targets through.

Dozer Price

Bulldozer Good Quality Bulldozer Price with powerful engine SD8N HP with Extended Straight Blade with powerful engine. $, - $, Looking for something else? Airplane For Sale · ATVs For Sale · Trucks For Sale · Motorcycles For Sale · Jet Skis For Sale · RVs. Showing all 12 results. Dozer (0 to 15 tons) Case B For Sale at EquipMtl · Case B Unit number: Price: CA$13, Here's a look at three (in no particular order) of the biggest – in size and selling price – that have passed through Ritchie Bros. as they're sold to buyers. Browse a wide selection of new and used Dozers for sale near you at mediacomponent.ru Find Dozers from CATERPILLAR, DEERE, KOMATSU. Buy surplus Dozers from Cat, John Deere, Komatsu, Liebherr, International, Allis Chalmers and more. Buy with confidence with our IronClad. $ , Like New Case M WT Enclosed Cab Dozer, Low Hours, Inside and Out in excellent condition. Bulldozer Price(+) · 1 Year Warranty. Shantui Brand Hp SD22 SD22W Bulldozer Price Crawler Bulldozer with Three Ripper · 3 months Warranty · 2 years. Find construction equipment of all makes & types, including Caterpillar, John Deere, Hitachi, Komatsu, and many more, listed for sale or rent here! Bulldozer Good Quality Bulldozer Price with powerful engine SD8N HP with Extended Straight Blade with powerful engine. $, - $, Looking for something else? Airplane For Sale · ATVs For Sale · Trucks For Sale · Motorcycles For Sale · Jet Skis For Sale · RVs. Showing all 12 results. Dozer (0 to 15 tons) Case B For Sale at EquipMtl · Case B Unit number: Price: CA$13, Here's a look at three (in no particular order) of the biggest – in size and selling price – that have passed through Ritchie Bros. as they're sold to buyers. Browse a wide selection of new and used Dozers for sale near you at mediacomponent.ru Find Dozers from CATERPILLAR, DEERE, KOMATSU. Buy surplus Dozers from Cat, John Deere, Komatsu, Liebherr, International, Allis Chalmers and more. Buy with confidence with our IronClad. $ , Like New Case M WT Enclosed Cab Dozer, Low Hours, Inside and Out in excellent condition. Bulldozer Price(+) · 1 Year Warranty. Shantui Brand Hp SD22 SD22W Bulldozer Price Crawler Bulldozer with Three Ripper · 3 months Warranty · 2 years. Find construction equipment of all makes & types, including Caterpillar, John Deere, Hitachi, Komatsu, and many more, listed for sale or rent here!

The industry's newest slant-nosed, intelligent HST dozer features the latest iMC capabilities, and patent-pending proactive dozing control. For a versatile and tough new Caterpillar dozer that outperforms the competition, boosts productivity, reduces operating costs and keeps operators safe, contact. Boyd CAT has 17 convenient locations in KY and Southern IN to serve you. Stop in for a closer look at our complete lineup of new and used dozers for sale today! CAT Crawler Dozers · CAT D5K2 LPG OROPS 6-WAY BLADE CRAWLER DOZER · CATERPILLAER D5K2 XL OROPS 6-WAY BLADE CRAWLER DOZER · Caterpillar D6K2 XL. model year L crawler dozer with John Deere's exclusive SmartGrade 3D grade & slope control in stock and available for sale RPO. Dozers are a piece of equipment primarily used to push large quantities of dirt, sand, rock, snow, or debris. Dozers are attached with a. Find versatile bulldozers for sale at a Ritchie Bros today! We offer a wide selection of dozers for sale from great brands such as Cat, John Deere. The Cat® D1 delivers superior performance and the broadest choice of technology features to help you get the most from your dozer. Nimble and responsive, it has. Most Popular Dozers Listings · Deere J LT · Caterpillar D4G LGP · Caterpillar D · Caterpillar D4K2 LGP · Caterpillar D5C XL HST. Bulldozers for sale: listings. From large to small, new, old, and used dozers, by CAT, Case, Komatsu, John Deere and more. Browse a wide selection of new and used Dozers Logging Equipment for sale near you at ForestryTrader CA. 18 Upcoming Crawlers For Sale · Caterpillar D5K2 LGP dozer · Caterpillar D5K2 XL dozer · Caterpillar D8R cable plow · Caterpillar D8R cable. Buy used Dozers from Cat, John Deere, Komatsu, Liebherr, International, Dressta and more. Buy with confidence with our IronClad. The Cat® D6 dozer helps you move material at a lower cost with a fully automatic transmission, outstanding fuel efficiency and reduced service/maintenance costs. Boyd CAT has 17 convenient locations in KY and Southern IN to serve you. Stop in for a closer look at our complete lineup of new and used dozers for sale today! Dozers · Komatsu D37EX · Komatsu D37PX · Komatsu D39EXi · Komatsu D39PX · Komatsu D39PXi · Komatsu D51EXi · Komatsu D51EX · Komatsu D51PX-. Browse a wide selection of new and used Dozers for sale near you at mediacomponent.ru Find Dozers from CATERPILLAR, DEERE, KOMATSU. Browse our selection to find a dozer for sale in Knoxville, TN that meets your needs, and contact our team if you have questions or need expert support. Build & Price your perfect machine based on your needs and budget. Our featured products are the MINI-DOZER® & the MAGNATRAC®. Tracks Make the Difference. Used Dozers for Sale. You can buy used bulldozers at fair prices without sacrificing reliability or efficiency. With the help of Cat Used, it's easy to find.

What If I Quit My Job And Have A 401k

You can cash out your (k) if you quit your job. However, experts generally do not advise cashing out a (k), as doing so will trigger taxes and penalties. (k) loans can be complex. Leaving a job with an outstanding (k) loan balance can be stressful, and you'll need to figure out how to repay the balance. Once you leave a job where you have a (k), you can no longer make contributions to the plan and no longer receive the match. There may be better investment. There could be income tax depending on how you pull it. When you take an early withdraw, the plan administrator can withhold twenty percent of. If your (k) or (b) balance has less than $1, vested in it when you leave, your former employer can cash out your account or roll it into an individual. Option 1: Leave the money with your former employer's (k) · Option 2: Roll it over to your new employer's (k) · Option 3: Roll into an IRA · Option 4: Cash. Leave the money where it is (assuming you meet the minimum required balance, typically $) · Roll the balance directly or indirectly into your new employer's. Option 1: Leave the money with your former employer's (k) · Option 2: Roll it over to your new employer's (k) · Option 3: Roll into an IRA · Option 4: Cash. When you leave a job, only vested contributions are yours to take. Any unvested contributions are returned to the employer. You can choose what to do with those. You can cash out your (k) if you quit your job. However, experts generally do not advise cashing out a (k), as doing so will trigger taxes and penalties. (k) loans can be complex. Leaving a job with an outstanding (k) loan balance can be stressful, and you'll need to figure out how to repay the balance. Once you leave a job where you have a (k), you can no longer make contributions to the plan and no longer receive the match. There may be better investment. There could be income tax depending on how you pull it. When you take an early withdraw, the plan administrator can withhold twenty percent of. If your (k) or (b) balance has less than $1, vested in it when you leave, your former employer can cash out your account or roll it into an individual. Option 1: Leave the money with your former employer's (k) · Option 2: Roll it over to your new employer's (k) · Option 3: Roll into an IRA · Option 4: Cash. Leave the money where it is (assuming you meet the minimum required balance, typically $) · Roll the balance directly or indirectly into your new employer's. Option 1: Leave the money with your former employer's (k) · Option 2: Roll it over to your new employer's (k) · Option 3: Roll into an IRA · Option 4: Cash. When you leave a job, only vested contributions are yours to take. Any unvested contributions are returned to the employer. You can choose what to do with those.

Generally, you can leave your money in your plan and retain its tax-deferred status. (This means you don't pay taxes on that money until you take a distribution). If you quit your job with an outstanding (k) loan, the IRS allows you up to the due date for federal tax returns for the following year plus any extensions. You have four basic options for handling your (k) when you leave your job, whether you quit, are laid off, or are fired. When you quit your job after establishing a (k), you will not receive the match anymore. You will have multiple other investment options. More often than not. If you quit a job, your k is your property. Your employer may not remove anything from the account unless you have some unvested employer. When you quit a job, your (k) stays where it is until you decide what to do with it. You can roll it over into your new (k), roll it into an IRA. If you are fired or laid off, you have the right to move the money from your k account to an IRA without paying any income taxes on it. This is called a “. Generally, if you withdraw money from your (k) account before age 59 1/2, must pay a 10% early withdrawal penalty, in addition to income tax, on the. Having a balance in an old employer's (k) plan is, obviously, better than not having it. If it does exist, you need to choose whether to keep it there . An employer-sponsored retirement plan may offer choices for what to do with your account balance in the plan when you decide to change jobs or retire. Quitting your job does not trigger a taxable event for your (k) funds unless you elect to cash out your account and take a distribution. Can I cash in all or part of my (k) if I need additional emergency funds? Yes. You have the option of cashing in your retirement plan, but you should. If your loan was in good standing as of the termination date, the distribution will be a qualified plan loan offset (QPLO), and you will have until your tax. When you quit your job after establishing a (k), you will not receive the match anymore. You will have multiple other investment options. More often than not. (k)—Your options may include leaving the money in your old employer's plan, rolling the money into an IRA, rolling it into your new employer's plan, or even. If I have been fired, can my old employer take my (k)? No, your old employer cannot take your (k) funds, including any contributions you made or are. If you're fired from a position, you can take all the money you contributed to your (k). Whether or not you get to take employer contributions depends on how. (k) loans can be complex. Leaving a job with an outstanding (k) loan balance can be stressful, and you'll need to figure out how to repay the balance. An employer-sponsored retirement plan may offer choices for what to do with your account balance in the plan when you decide to change jobs or retire. Can I cash in all or part of my (k) if I need additional emergency funds? Yes. You have the option of cashing in your retirement plan, but you should.

American Modern Classic Car Insurance Reviews

Mobile Home. Since we've been protecting classic mobile homes and today's upscale manufactured housing. · Vacation Home · Collector Car · Motorcycle. You only find out how good an insurance company is when you need to use them or make changes; it's a shame that they all can not be this helpful. If you have a. American Modern Insurance Group reviews · Doesn't explain coverages well · Limited billing options. Best insurance for classic cars ; American National, Foremost (J.C. Taylor), Classic Collectors (Infinity Insurance) ; Farmers, Geico (American Modern). Classic Car Policy: Loyal customer disappointed in the end. I would not choose them ever again. I had two collector cars insured with them for four years and. Collector Car Insurance Policies from American Collectors Insurance. Product Modern classic cars; Collector trucks and SUVs; Antique tractors or farm. Overall financial ratings of American Modern Insurance are outstanding. AM Best awarded it an A+ grade, indicating that the company has robust financial. Runner-Up: American Modern Insurance Review American Modern Insurance offers feature-rich, agreed-value plans that are highly customizable with four mileage. American Modern Insurance is easy and fast. They always answer phone calls and the agents are quite friendly. They offered me great rates for the first year. Mobile Home. Since we've been protecting classic mobile homes and today's upscale manufactured housing. · Vacation Home · Collector Car · Motorcycle. You only find out how good an insurance company is when you need to use them or make changes; it's a shame that they all can not be this helpful. If you have a. American Modern Insurance Group reviews · Doesn't explain coverages well · Limited billing options. Best insurance for classic cars ; American National, Foremost (J.C. Taylor), Classic Collectors (Infinity Insurance) ; Farmers, Geico (American Modern). Classic Car Policy: Loyal customer disappointed in the end. I would not choose them ever again. I had two collector cars insured with them for four years and. Collector Car Insurance Policies from American Collectors Insurance. Product Modern classic cars; Collector trucks and SUVs; Antique tractors or farm. Overall financial ratings of American Modern Insurance are outstanding. AM Best awarded it an A+ grade, indicating that the company has robust financial. Runner-Up: American Modern Insurance Review American Modern Insurance offers feature-rich, agreed-value plans that are highly customizable with four mileage. American Modern Insurance is easy and fast. They always answer phone calls and the agents are quite friendly. They offered me great rates for the first year.

Car Collectors Trust Heacock Classic. All Reviews. Why Choose Heacock? Collector Car Insurance · Antique and Classic Cars · Modern Collector Cars · Muscle. NCM Insurance Agency Collector Vehicle Insurance is at Corvettes at Carlisle. 2d. Team Chevrolet made a presentation on the. American Modern Insurance Group. Favorite. Overview · Reviews. 7 · Q&A. About Whether it's a seasonal home by the lake or a prized collector vehicle, American. We specialize in covering antique and classic cars, collector cars, reproductions, replicas, restorations, and modern classics. Learn more and get a quote. Classic Car Policy: Loyal customer disappointed in the end. I would not choose them ever again. I had two collector cars insured with them for four years and. American Modern provides high quality insurance for your classic, collector, vintage or antique car. Collector Car Insurance from Classic Auto. Customer Reviews. Get a Quote. I American Modern Insurance Group, a nationally recognized, A+ rated provider of. review your policy and contact a customer service agent to discuss your Collector auto insurance is written through American Modern Insurance Group. We specialize in covering antique and classic cars, collector cars, reproductions, replicas, restorations, and modern classics. Learn more and get a quote. Customer Reviews. INSURANCE. Collector Car Insurance Beach Coast Insurance & Financial Services Provides Classic Auto/Car Insurance, Homeowners Insurance. They offer a variety of discounts for snowmobile, collector car, boat, personal watercraft, motorcycle, ATV and golf cart insurance. American Modern snowmobile. Since , car collectors have trusted American Collectors Insurance for Agreed Value classic car insurance and #1 rated customer service. American Modern is our No. 1 pick for classic car insurance, as it is known for its comprehensive spare parts coverage. Safeco is a good choice for daily. In need of insurance for your collector vehicle? car club liability? or HPDE (High-Performance Driver Education coverage? Contact us today! Collector auto insurance is written through American Modern Insurance Group or Assurant and is secured through the GEICO Insurance Agency LLC. Please note: The. Coverage is subject to policy terms, conditions, limitations, exclusions, underwriting review and approval, and may vary or not be available for all risks or in. American Modern: American Modern provides classic and collector car insurance for an extensive array of vehicles. American Modern offers unlimited mileage. I use American Modern, which is USAA's classic car insurance subsidiary. They insure my TR6 and MGB, dollars per year, mi limit each, per year. American Modern Insurance Group is licensed in 50 states and have been in property and casualty business since They are based in Cincinnati, OH, and are. Collector Car Insurance from Classic Auto. Customer Reviews. Get a Quote. I American Modern Insurance Group, a nationally recognized, A+ rated provider of.

Roth Ira Phase Out Calculation

The Roth IRA income limit to make a full contribution in is less than $, for single filers, and less than $, for those filing jointly. If you'. Use this calculator to compute the amount you can save in a Roth IRA where you pay taxes on your income now, but withdraw the funds tax-free in retirement. Roth IRA phase-out ranges ; Single. income range. $,–$, ; Married, filing jointly. income range. $,–$, ; Married, filing. Roth IRA contributions are limited for higher incomes. If your income falls in a 'phase-out' range you are allowed only a prorated Roth IRA contribution. If. Roth IRA phase-out ranges ; Single. income range. $,–$, ; Married, filing jointly. income range. $,–$, ; Married, filing. If you overcontributed to your Roth IRA due to your income limit, you can recharacterize your Roth IRA contributions to a traditional IRA. Just make sure you do. Information about IRA contribution limits. Learn about tax deductions, IRAs and work retirement plans, spousal IRAs and more. Key takeaways · The Roth IRA contribution limit for is $7, for those under 50, and $8, for those 50 and older. · Your personal Roth IRA contribution. Use this free Roth IRA calculator to estimate your account balance at retirement and determine how much you are eligible to contribute in The Roth IRA income limit to make a full contribution in is less than $, for single filers, and less than $, for those filing jointly. If you'. Use this calculator to compute the amount you can save in a Roth IRA where you pay taxes on your income now, but withdraw the funds tax-free in retirement. Roth IRA phase-out ranges ; Single. income range. $,–$, ; Married, filing jointly. income range. $,–$, ; Married, filing. Roth IRA contributions are limited for higher incomes. If your income falls in a 'phase-out' range you are allowed only a prorated Roth IRA contribution. If. Roth IRA phase-out ranges ; Single. income range. $,–$, ; Married, filing jointly. income range. $,–$, ; Married, filing. If you overcontributed to your Roth IRA due to your income limit, you can recharacterize your Roth IRA contributions to a traditional IRA. Just make sure you do. Information about IRA contribution limits. Learn about tax deductions, IRAs and work retirement plans, spousal IRAs and more. Key takeaways · The Roth IRA contribution limit for is $7, for those under 50, and $8, for those 50 and older. · Your personal Roth IRA contribution. Use this free Roth IRA calculator to estimate your account balance at retirement and determine how much you are eligible to contribute in

May I contribute to a Roth IRA after age 72? Yes, no age limit is imposed for Roth IRA contributions. You must have earned income for the year for which the. Eligibility to make Roth IRA contributions starts to phase out once your modified adjusted gross income (MAGI) exceeds certain limits as shown below. Roth. For the tax year, you can contribute up to $7,, or $8, if you are 50 or older. amount is $6, and $7, respectively for tax year Calculate your IRA contribution limits. When it comes to IRAs, your age, income and filing status all have a say in how much you can tuck away. mediacomponent.ru provides a FREE Roth IRA calculator and other k calculators to help consumers determine the best option for retirement savings. Use this free Roth IRA calculator to estimate your account balance at retirement and determine how much you are eligible to contribute in Roth IRA Income Limits ; Less than $,, $6, ($7, if age 50 or older) ; $, to $,, Begin to phase out ; $, or more, Ineligible for. Roth IRAs have income limits that prohibit higher earners from contributing. For , Roth IRA contributions are reduced if income is between $, and. Is phased out completely when your income is more than $, if you are Single or Head of Household, or $, if Married Filing Jointly; Married couples. The amount you will contribute to an IRA each year. This calculator assumes that you make your contribution at the beginning of each year. For , the maximum. Eligibility to make Roth IRA contributions starts to phase out once your modified adjusted gross income (MAGI) exceeds certain limits as shown below. Roth. Roth IRA - Am I Eligible?Collapse · Full contribution if MAGI is less than $, (single) or $, (joint); Partial contribution if MAGI is between. Income limit–The income limit disqualifies high income earners from participating in Roth IRAs. As mentioned before, the limits are adjusted gross incomes of. "The amount of the nondeductible contribution is limited to the maximum you are eligible to contribute each year, after taking other IRA. However, there are two unusual situations not automatically accounted for where additional tax phase-outs are applied. First, if your spouse has an employer-. If your income falls in a 'phase-out' range you are allowed only a prorated Roth IRA contribution. If your income exceeds the phase-out range, you do not. The 'catch-up' contribution amount of $1, remains unchanged for , but will be adjusted for inflation in $ increments starting in In order to. Total value in your Roth IRA at your retirement. To take any distributions that include earnings that are tax free, the Roth IRA must be opened for 5 tax years. If you are 50 or older you can make an additional 'catch-up' contribution of $1, The 'catch-up' contribution amount of $1, remains unchanged for Contribution limits for these are different from the more popular IRAs above; for , the limit is the lesser of 25% of gross income, or $69, This is.

The Different Types Of Insurance

General insurance refers to a variety of insurance plans that provide financial protection against losses caused as a result of liabilities such as a bike. Between health insurance, life insurance, disability insurance, long term care insurance, and more, learn the different types of insurance. 4 Types of Insurance Policies and Coverage You Need · 1. Life Insurance · 2. Health Insurance · 3. Long-Term Disability Coverage · 4. Auto Insurance. The following table outlines various types of policies ; X Available. Not Applicable, Not Applicable, Not Applicable ; Not Applicable. X Available. X Available. Types of Car Insurance · Auto Glass Insurance · Bodily Injury Liability Insurance · Collision Insurance · Comprehensive Insurance · Gap Insurance · Medical Payments. When shopping around for coverage, you may come across various products that fall into two main categories: term life and permanent life (also commonly referred. Most common types of insurance · Auto Insurance · Home Insurance · Renters Insurance · Life Insurance. There are several types of permanent life insurance—the most common types being whole life insurance and universal life insurance. Types of Insurance · Health Insurance · Home Insurance · Auto Insurance · Life Insurance · Travel Insurance. General insurance refers to a variety of insurance plans that provide financial protection against losses caused as a result of liabilities such as a bike. Between health insurance, life insurance, disability insurance, long term care insurance, and more, learn the different types of insurance. 4 Types of Insurance Policies and Coverage You Need · 1. Life Insurance · 2. Health Insurance · 3. Long-Term Disability Coverage · 4. Auto Insurance. The following table outlines various types of policies ; X Available. Not Applicable, Not Applicable, Not Applicable ; Not Applicable. X Available. X Available. Types of Car Insurance · Auto Glass Insurance · Bodily Injury Liability Insurance · Collision Insurance · Comprehensive Insurance · Gap Insurance · Medical Payments. When shopping around for coverage, you may come across various products that fall into two main categories: term life and permanent life (also commonly referred. Most common types of insurance · Auto Insurance · Home Insurance · Renters Insurance · Life Insurance. There are several types of permanent life insurance—the most common types being whole life insurance and universal life insurance. Types of Insurance · Health Insurance · Home Insurance · Auto Insurance · Life Insurance · Travel Insurance.

Types of coverage include student accident, sports accident, travel accident, blanket accident, specific accident or accidental death and dismemberment (AD&D). There are many types of health coverage such as PPOs, EPOs and HMOs. Each one is a little different. Read below for more information. When you start to consider the various types of auto insurance coverage available it can get overwhelming. · 1. Liability Insurance · 2. Collision Coverage · 3. Types of Life Insurance Policies · Whole Life Insurance · Term Life Insurance · Universal Life Insurance · Final expense insurance · Group Life Insurance. Dental and vision insurance · Hospital indemnity insurance · Critical illness insurance and cancer insurance · Accident insurance · Legal insurance · Pet insurance. 1. What are the 5 major types of insurance? · Life Insurance · Health Insurance · Fire Insurance · Marine Insurance · Vehicle Insurance. Liability Coverage; Collision Coverage; Comprehensive Coverage; Uninsured/Underinsured Motorist Coverage; Medical Payments Coverage; Personal Injury Protection. Property insurance · Homeowners insurance · Renters insurance · Condo insurance · Landlord insurance · Flood insurance. We're bringing you seven types of insurance you may need to purchase throughout your life and how they apply to you. Types of insurance · Buying insurance for your mobile phone · Household contents insurance · Buildings insurance · Income protection insurance · Travel insurance. 8 Types of Insurance Policies for Small Businesses to Consider · General liability insurance helps protect your business from claims that it caused: · Commercial. Insurance Types · Life · Long-Term Care · Medicare Supplement · Professional Liability · Title · Warranties and Motor Vehicle Service Agreements · Workers'. What are the different types of health insurance? · Health Maintenance Organizations (HMOs) · Exclusive Provider Organizations (EPOs) · Point-Of-Service (POS). Most experts recommend term life insurance for cheap and straightforward coverage, but the right policy for you will depend on your overall financial situation. This insurance covers some of the same types of services as comprehensive health insurance, but is not required to offer a full set of essential health benefits. There are different types of health insurance plans to fit different needs. Learn about options like ACA, Medicare, Medicaid, COBRA, short term and more. Types of Term Insurance · Renewable Term. Renewable term plans give you the right to renew for another period when a term ends, regardless of the state of your. Types · Vehicle insurance · Gap insurance · Health insurance · Income protection insurance · Casualty insurance · Life insurance · Burial insurance · Property. Title Insurance · Disability Insurance · Workers Compensation Insurance · Travel Insurance · Pet Insurance · Guaranteed Automobile Protection Insurance · Small. Here are a few of the basic car insurance types, how they work and what they cover. Liability coverage Liability coverage is required in most US states as a.

Definition Of Total Disability

Inability to Work: The individual must be unable to perform the duties of their own occupation or any occupation, depending on the specific definition used in. Definition of Total Disability: Although this definition can vary by plan, generally insureds are considered totally disabled if they are unable to perform. You have a permanent and total disability if you can't engage in any substantial gainful activity because of your physical or mental condition. The definition of total disability typically provides that you are unable to do the important duties of your occupation or the material and substantial duties. Total Disability Definition A long term disability income policy pays benefits should you become totally disabled. This begs the question: how is "total. Every LTD policy has a different definition of the term, but it generally means that you are unable to perform the essential tasks of your job due to an injury. The definition as a whole constitutes a strict test of permanent and total disability, which would operate as a safeguard against unjustified claims. The law defines disability as the inability to engage in any substantial gainful activity (SGA) by reason of any medically determinable physical or mental. Generally speaking, it means that because of a sickness or injury, a person is unable to work in their own or any occupation for which they are suited by. Inability to Work: The individual must be unable to perform the duties of their own occupation or any occupation, depending on the specific definition used in. Definition of Total Disability: Although this definition can vary by plan, generally insureds are considered totally disabled if they are unable to perform. You have a permanent and total disability if you can't engage in any substantial gainful activity because of your physical or mental condition. The definition of total disability typically provides that you are unable to do the important duties of your occupation or the material and substantial duties. Total Disability Definition A long term disability income policy pays benefits should you become totally disabled. This begs the question: how is "total. Every LTD policy has a different definition of the term, but it generally means that you are unable to perform the essential tasks of your job due to an injury. The definition as a whole constitutes a strict test of permanent and total disability, which would operate as a safeguard against unjustified claims. The law defines disability as the inability to engage in any substantial gainful activity (SGA) by reason of any medically determinable physical or mental. Generally speaking, it means that because of a sickness or injury, a person is unable to work in their own or any occupation for which they are suited by.

Under the any occupation definition of total disability, the insured must be unable to engage in any occupation in order to be considered totally disabled. In. Total disability is when a person is unable to perform their job duties due to a physical or mental impairment. This can be a temporary or permanent. N.J. Admin. Code § - Definition of total disability (a) The participant will be considered totally disabled if he or she is unable to perform each. Total Disability legal definition: The term total disability refers to an injury that completely impairs a person's physical or mental. As far as the Social Security Administration (SSA) is concerned, you either have a disability that prevents you from working a substantial amount, or you don't. The insured is considered disabled if he or she is unable to perform the duties pertaining to any gainful occupation. It limits payments to those insured's who. Provides for payment of the total disability benefit from the first day of hospitalization as long as the insured satisfies the definition of total disability. Total Disability means any physical or mental disability that prevents Executive from performing one or more of the essential functions of his position for a. A disability is permanent when healing ends but an impairment remains. Workers' compensation law awards different kinds of benefits to workers who have. The meaning of TOTAL DISABILITY is a degree of disability considered sufficient (as according to statute or in an insurance policy) to make one unable to. Total disability means you cannot perform the essential or regular duties of your occupation or any occupation. Partial disability means you can still work to. Total disability is typically defined as being unable to perform the substantial and material duties of your occupation at the onset of your claim. A residual. Definition of Total Disability in a Disability Policy Which Required That the Insured Not Be Able to Perform 'The Duties of Any Gainful Occupation for Which [He. The definition of disability under Social Security is different than other programs. We pay only for total disability. No benefits are payable for partial. Instead, the term “total disability” is ascribed its own meaning by the LTD policy as well as the courts. Many LTD policies define “total disability” as the. The insured is considered disabled if he or she is unable to perform the duties pertaining to any gainful occupation. It limits payments to those insured's who. Talk to a Fitter Law attorney: the legal definition of total disability encompasses the complete inability to work or carry out job duties, regardless of the. A residual or partial benefit allows you to qualify for benefits when a disability isn't a total disability, but rather when sickness or injury prevents you. This level of disability reflects an injury that has rendered the employee completely unable to perform any job functions on a temporary basis.

Lilly Ledbeter Fair Pay Act

Lilly Ledbetter Fair Pay Act Letter Dear Representative: On May 29, , the Supreme Court issued a decision in Ledbetter v. Goodyear Tire & Rubber Company. It started with #MeToo, before there was #MeToo. Then, for decades she fought to close the pay gap between women's and men's wages for equal work. The act amends Title VII of the Civil Rights Act of and states that the day statute of limitations for filing an equal-pay lawsuit regarding pay. The result was the Lilly Ledbetter Fair Pay Act of Closed captions available in English and Spanish. Awards & Honors. ABA Silver Gavel Award; Bronze. The Impact of the Lilly Ledbetter Fair Pay Act of An Immediate Look at the Legal, Governmental, and Economic Ramifications of New Legislation Regarding. The Lilly Ledbetter Fair Pay Act of was recently signed into law. The Fair Pay Act supersedes the U.S. Supreme Court's May decision in Ledbetter v. SECTION 1. SHORT TITLE. This Act may be cited as the ''Lilly Ledbetter Fair Pay Act of ''. An act to amend title VII of the Civil Rights Act of and the Age Discrimination in Employment Act of , and to modify the operation of the Americans. The Lily Ledbetter Fair Pay Act allowed women and other people being discriminated against to dispute pay disparities from any period of their career. They. Lilly Ledbetter Fair Pay Act Letter Dear Representative: On May 29, , the Supreme Court issued a decision in Ledbetter v. Goodyear Tire & Rubber Company. It started with #MeToo, before there was #MeToo. Then, for decades she fought to close the pay gap between women's and men's wages for equal work. The act amends Title VII of the Civil Rights Act of and states that the day statute of limitations for filing an equal-pay lawsuit regarding pay. The result was the Lilly Ledbetter Fair Pay Act of Closed captions available in English and Spanish. Awards & Honors. ABA Silver Gavel Award; Bronze. The Impact of the Lilly Ledbetter Fair Pay Act of An Immediate Look at the Legal, Governmental, and Economic Ramifications of New Legislation Regarding. The Lilly Ledbetter Fair Pay Act of was recently signed into law. The Fair Pay Act supersedes the U.S. Supreme Court's May decision in Ledbetter v. SECTION 1. SHORT TITLE. This Act may be cited as the ''Lilly Ledbetter Fair Pay Act of ''. An act to amend title VII of the Civil Rights Act of and the Age Discrimination in Employment Act of , and to modify the operation of the Americans. The Lily Ledbetter Fair Pay Act allowed women and other people being discriminated against to dispute pay disparities from any period of their career. They.

The FPA extends the limitations period for compensation discrimination claims and is retroactive in nature, its impact will be far reaching. Her work led to the Lilly Ledbetter Fair Pay Act, signed into law in The law loosens time restrictions on filing discrimination cases, resetting the Bluebook · Public Law - 2 - Lilly Ledbetter Fair Pay Act of · Category · Collection · SuDoc Class Number · Law Number · Date Approved · Full Title. Lilly Ledbetter Fair Pay Act President Barack Obama signed his first bill into law Thursday, an equal-pay measure championed by labor and women's rights. The Act restores the pre-Ledbetter position of the EEOC that each paycheck that delivers discriminatory compensation is a wrong actionable under the federal EEO. Summary. On January 13, , Senate Majority LeaderReid filed a cloture petition on the motion to proceed to S. , the Lilly Ledbetter Fair Pay Act of Primary tabs. An act named after plaintiff Lilly Ledbetter of the Ledbetter v. Goodyear Tire & Rubber Co., Inc. case which facilitated the process of bringing. Summary. On January 13, , Senate Majority LeaderReid filed a cloture petition on the motion to proceed to S. , the Lilly Ledbetter Fair Pay Act of In response to this ruling, Congress passed the Lilly Ledbetter Fair Pay Act in which altered the definition of what an unlawful employment practice when. Lilly Ledbetter began working for Goodyear Tire Company in After retiring in , Ledbetter brought suit against Goodyear under Title VII of the Civil. Lilly Ledbetter Fair Pay Act of · President Obama signing the Lilly Ledbetter Fair Pay Act of · Ledbetter speaks during the second day of the Yet all was not lost. Thanks in part to her advocacy, President Obama signed The Lilly Ledbetter Fair Pay Act of , which allows people to fight ongoing. AFSCME will support the Paycheck Fairness Act and will lobby in favor of legislation created to strengthen the Lilly Ledbetter Fair Pay Act of The Lily Ledbetter Act makes it easier for women to challenge unequal pay in court by effectively extending the statute of limitations on filing a claim. The FPA extends the limitations period for compensation discrimination claims and is retroactive in nature, its impact will be far reaching. The result was the Lilly Ledbetter Fair Pay Act of Closed captions available in English and Spanish. Awards & Honors. ABA Silver Gavel Award; Bronze. Just nine days after taking office, President Obama signed the first piece of legislation to reach his desk: the Lilly Ledbetter Fair Pay Act ("Ledbetter Act"). On January 29, , President Barack Obama signed into law the Lilly Ledbetter Fair Pay Act. The Act requires employers to redouble their efforts to ensure. STUDENT WORKSHEET #4 – “Lilly Ledbetter Fair Pay Act”. Name: Instructions: Visit the.

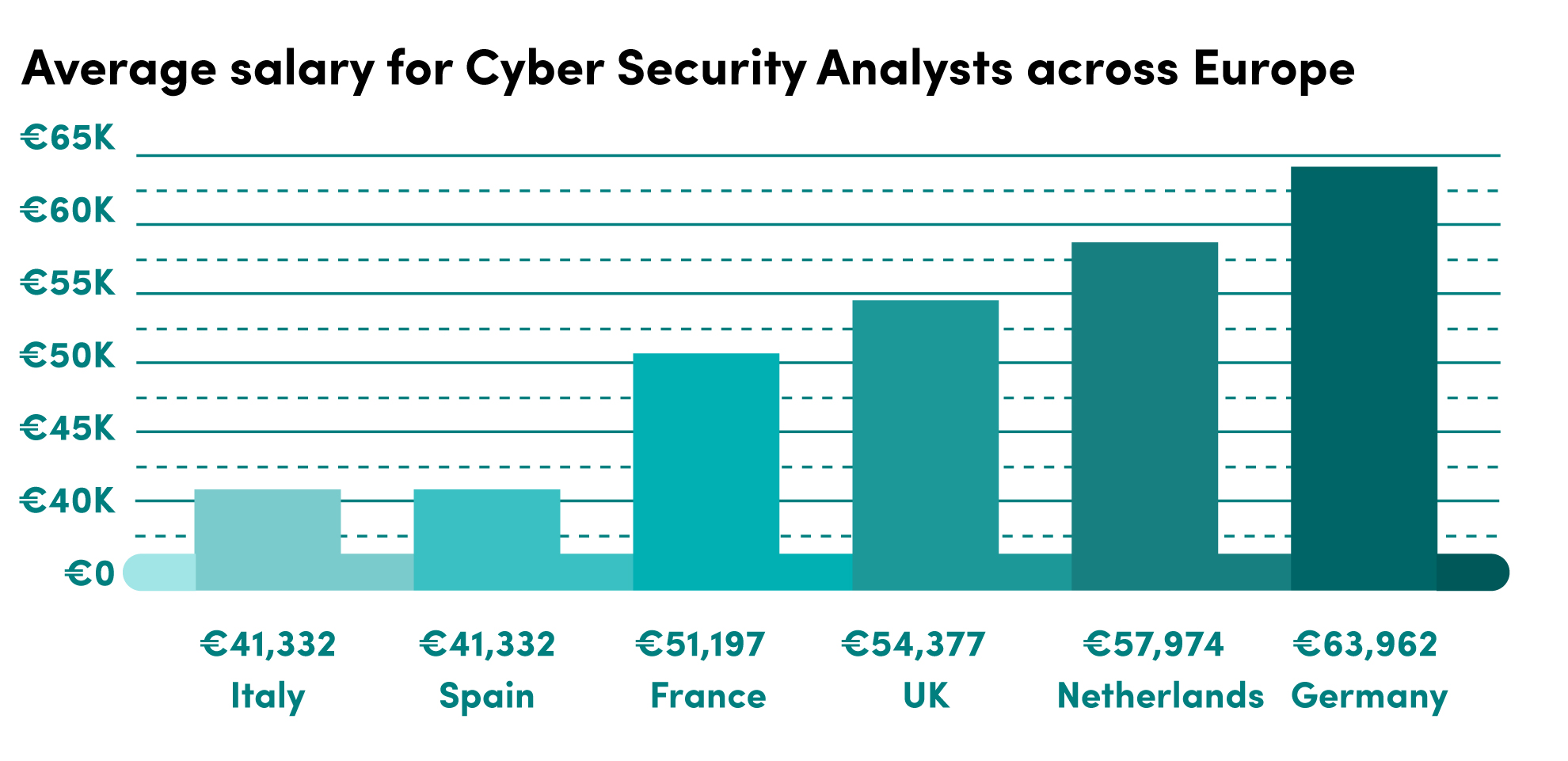

It Network Security Salary

Base salary between $k-$k with % annual bonus and $10k per year stock options each fully vested after three years. Paid SANS training. Cyber Security - Salary - Get a free salary comparison based on job title, skills, experience and education. Accurate, reliable salary and compensation. A Computer Networking Security in your area makes on average $36 per hour, or $ (%) more than the national average hourly salary of $ ranks. Companies throughout the Golden State hire cybersecurity specialists, who can expect to earn salaries within the ranges shown here. How Much Does an Information Security Analyst Make? Information Security Analysts made a median salary of $, in The best-paid 25% made $, that. The average Network Security Specialist salary in the United States is $ as of July 29, , but the salary range typically falls between $ and. Cyber security specialist | $90, ; Associate network analyst | $74, ; Cyber crime analyst | $90, ; IT auditor | $69, ; Incident analyst | $80, Network Security Engineers make an average of $ / year in USA, or $ / hr. Try mediacomponent.ru's salary tool and access the data you need. years experience in various other IT related focuses (sysadmin, network design, etc). Currently at $85k with great benefits, WFH, strict Base salary between $k-$k with % annual bonus and $10k per year stock options each fully vested after three years. Paid SANS training. Cyber Security - Salary - Get a free salary comparison based on job title, skills, experience and education. Accurate, reliable salary and compensation. A Computer Networking Security in your area makes on average $36 per hour, or $ (%) more than the national average hourly salary of $ ranks. Companies throughout the Golden State hire cybersecurity specialists, who can expect to earn salaries within the ranges shown here. How Much Does an Information Security Analyst Make? Information Security Analysts made a median salary of $, in The best-paid 25% made $, that. The average Network Security Specialist salary in the United States is $ as of July 29, , but the salary range typically falls between $ and. Cyber security specialist | $90, ; Associate network analyst | $74, ; Cyber crime analyst | $90, ; IT auditor | $69, ; Incident analyst | $80, Network Security Engineers make an average of $ / year in USA, or $ / hr. Try mediacomponent.ru's salary tool and access the data you need. years experience in various other IT related focuses (sysadmin, network design, etc). Currently at $85k with great benefits, WFH, strict

The average salary for a Network Security Analyst is $ per year in United States. Click here to see the total pay, recent salaries shared and more! Many jobs pay six-figures, and some top talent receive nearly $1 million in compensation. Still, cybersecurity jobs can be stressful, and generative AI has only. Cyber Security Salaries in the US for Freshers and Experienced Professionals. The average cyber security salary in the US ranges from $88, to $, per. Cyber Security Analysts make an average of $ / year in California, or $ / hr. Try mediacomponent.ru's salary tool and access the data you need. Cybersecurity Salaries by Location · Data Security Analyst: $, – $, · Systems Security Administrator: $, – $, · Network Security. As a CISO, you have one of the highest paying jobs in cyber security. The salary starts from $, and up to $,, making the median salary somewhere. The salary in cyber security varies depending on the position, experience, skills, and location. However, it is generally a well-paying. The average NETWORK CYBER SECURITY SALARY in the United States as of July is $ an hour or $ per year. Get paid what you're worth! The average salary for a Cybersecurity Engineer in US is $ Learn more about additional compensation, pay by gender and years of experience for. The average salary for a Network Security Specialist is $ per year, or $40 per hour in United States. Find out the average a salary by state. The estimated total pay for a Network Security Engineer is $, per year, with an average salary of $, per year. These numbers represent the. The U.S. Bureau of Labor and Statistics (BLS) reports that information security analysts earned a median annual salary of $, as of In this Article. The U.S. Bureau of Labor and Statistics (BLS) reports that information security analysts earned a median annual salary of $, as of In this Article. According to the BLS, cybersecurity and information security analysts earn an average annual salary of $, per year ($ per hour).* With enough. The average salary for a Network Security Engineer is $ per year, or $42 per hour in United States. Find out the average a salary by state. The average Network Security Engineer salary in the United States is $ as of July 29, , but the salary range typically falls between $ and. The average Network Security Manager salary in the US is $ How much does a Network Security Manager make near you? Get a free salary report. Between January and October , the median advertised salary for cybersecurity (also known as information security) professionals with a master's degree was. The median annual wage for information security analysts was $, in May Job Outlook. Employment of information security analysts is projected to grow. Network Security Engineer Job Description · Maintaining LAN, WLAN and architecture of the server as per the business policy · As a precautionary measure.