mediacomponent.ru Market

Market

What Is A Lender

Lender Definition. A lender is an individual or institution that provides the opportunity to borrow a substantial amount of money. A prospective borrower. A lender is a person or an institution that lends money to people. [business]. Click for English pronunciations, examples sentences, video. A lender refers to an individual or financial institution that provides loans to an individual, corporation, or public department in exchange for the principal. B lenders are generally more lenient and flexible regarding qualification criteria. They can consider alternative income sources and make exceptions for higher. TRICK 3 Most lenders advertise their “best rate”. By this they mean that if you are the “perfect” customer with the highest FICO score, lowest LTV (highest. The lender may, for example, propose solutions to credit or other problems regarding an application, identify compensating factors, and provide encouragement to. Lender. A lender gives money to a borrower with the agreement that it will be paid back within a certain time. While people often think of lenders as banks. A mortgage lender is an entity that provides financing for the purchase of real estate. Contact Calgary and Edmonton mortgage broker to discuss about. A real estate lender is an individual or institution that finances the purchase of real property, usually by issuing a loan to a buyer. Lender Definition. A lender is an individual or institution that provides the opportunity to borrow a substantial amount of money. A prospective borrower. A lender is a person or an institution that lends money to people. [business]. Click for English pronunciations, examples sentences, video. A lender refers to an individual or financial institution that provides loans to an individual, corporation, or public department in exchange for the principal. B lenders are generally more lenient and flexible regarding qualification criteria. They can consider alternative income sources and make exceptions for higher. TRICK 3 Most lenders advertise their “best rate”. By this they mean that if you are the “perfect” customer with the highest FICO score, lowest LTV (highest. The lender may, for example, propose solutions to credit or other problems regarding an application, identify compensating factors, and provide encouragement to. Lender. A lender gives money to a borrower with the agreement that it will be paid back within a certain time. While people often think of lenders as banks. A mortgage lender is an entity that provides financing for the purchase of real estate. Contact Calgary and Edmonton mortgage broker to discuss about. A real estate lender is an individual or institution that finances the purchase of real property, usually by issuing a loan to a buyer.

Shop for a loan, not a lender. You may have a long-term relationship with your bank, but that doesn't mean they will give you the best deal. Most loans are sold. What Does a Private Lender Mean? Essentially, the term private lender means that a non-institutional lender is loaning you money. They're not tied to any major. The recipient and the lender must agree on the terms of the loan before any money changes hands. In some cases, the lender requires the borrower to offer an. Standards may differ from lender to lender, but there are four core components — the four C's — that lenders will evaluate in determining whether they will. A lender is a financial institution that lends money to a corporate or an individual borrower with the expectation that the money will be repaid at a later date. A lender inspection is an onsite evaluation conducted by or for a lender to assess a property's condition and project progress, ensuring compliance with. A portfolio lender keeps all the loans they make on their own books, which means they don't sell your mortgage to other financial institutions or Fannie Mae or. A lender is a person or an institution that lends money to people. [business]. Click for English pronunciations, examples sentences, video. Businesses often prepare highly optimistic projections for investor pitches to show the market potential. Lenders, on the other hand, want to see realistic. The Division of Banks licenses and examines mortgage lenders, brokers, and loan originators. Learn more about the regulation of mortgage lenders, brokers. Creditors would be any institution, individual, or company that the company owes money to. So if a lender makes a loan to a company, then they would become a. A lender is a person or business that loans money. If you need cash to get your lemonade stand up and running, you'll have to find a lender and borrow The borrower agrees to pay back the lender with monthly mortgage payments that include principal, interest and other fees. lender the right to repossess the. What is a Private Lender Mortgage? In unique situations, it can make more sense for lendees to look outside conventional loan options even for something like a. If the lender's explanation is found to be not credible, the agency may find that the lender discriminated. Page 3. IV. Fair Lending — Fair Lending Laws and. Mortgagee: A lender or creditor who holds a mortgage or Deed of Trust. Mortgagor: A borrower who is obligated to pay on a mortgage or Deed of Trust. Back to top. (1) No prepayment fees or penalties shall be contracted by the borrower and lender with respect to any home loan in which: (i) the principal amount borrowed is. Lending officers have no fiduciary obligation to the borrower. Commercial lenders are trained in this and are expected to act as a lender only and not as an. The lender will typically be a financial institution, such as a bank, credit union or building society, depending on the country concerned, and the loan. A mortgage is a loan you get from a lender to finance a home purchase. When you take out a mortgage, you promise to repay the money you've borrowed at an agreed.

Use Ira As Collateral For Loan

The real estate purchased in a self-directed IRA is used as collateral. In the event of foreclosure or default, the lender can only pursue the IRA asset. This is a type of loan where the borrower is the retirement account rather than an individual. It's secured by collateral, typically real estate and conforms to. IRS rules prohibit the use of IRA loan funds for certain investments, such as life insurance or collectibles. But you can use non-recourse IRA loan proceeds to. Should you ever default on your loan, you will only lose your collateral and nothing else. Since the loan is for your IRA, your credit will not drop, and you. You're considered a disqualified person to your IRA if you were to sign a personal guarantee of a IRA loan. In that particular instance, you'd be engaging in a. Use for a real estate investment, business startup, or other expense; cannot be used for buying securities or paying down margin loans. Understand a Pledged. No, you cannot borrow money directly from your IRA. Unlike some employer-sponsored retirement plans, IRAs don't allow for loans. borrowing options by using their own assets as collateral. But doing so exposes those assets to increased risk, so you've got to have the fortitude and. However, the IRA can also use other assets like automobiles, private stock, and livestock as collateral. In case of default by the borrower, the IRA takes. The real estate purchased in a self-directed IRA is used as collateral. In the event of foreclosure or default, the lender can only pursue the IRA asset. This is a type of loan where the borrower is the retirement account rather than an individual. It's secured by collateral, typically real estate and conforms to. IRS rules prohibit the use of IRA loan funds for certain investments, such as life insurance or collectibles. But you can use non-recourse IRA loan proceeds to. Should you ever default on your loan, you will only lose your collateral and nothing else. Since the loan is for your IRA, your credit will not drop, and you. You're considered a disqualified person to your IRA if you were to sign a personal guarantee of a IRA loan. In that particular instance, you'd be engaging in a. Use for a real estate investment, business startup, or other expense; cannot be used for buying securities or paying down margin loans. Understand a Pledged. No, you cannot borrow money directly from your IRA. Unlike some employer-sponsored retirement plans, IRAs don't allow for loans. borrowing options by using their own assets as collateral. But doing so exposes those assets to increased risk, so you've got to have the fortitude and. However, the IRA can also use other assets like automobiles, private stock, and livestock as collateral. In case of default by the borrower, the IRA takes.

The Internal Revenue Service (IRS) does not allow (k) participants to use their retirement accounts as collateral for a loan. If you pledge your (k) as. While you cannot take a loan from your IRA, you can make an indirect rollover. IRA rollovers are common. For example, you might close out one retirement account. With a traditional IRA, you must pay taxes when you take the money out (since unlike a Roth IRA, you don't pay taxes on the deposits you make). The first-time. IRA holders cannot extend their personal credit to their IRAs. Thus, prospective investments must have sufficient income potential to convince a lender to fund. Loans are not permitted from IRAs or from IRA-based plans such as SEPs, SARSEPs and SIMPLE IRA plans. Loans are only possible from qualified plans. Use money in your savings or share certificate as collateral for a loan. Your loan is fully protected by pledging funds in non-IRA share certificates. To lend money with your Self-Directed IRA, you will issue a secured or unsecured promissory note, mortgage or deed of trust. In order to complete the loan. As such, an IRA or k must obtain a non-recourse mortgage. In this type of loan, you are not utilizing your credit to qualify and are not pledging your. Securities in a Wells Fargo Bank Priority Credit Line or Priority Credit Line collateral account must meet collateral eligibility requirements. There are. An LMA account is a secured line of credit that uses your eligible securities, such as stocks and bonds, as collateral. There are no fees to establish, no. There is no IRS rule for an IRA loan, but you can take out funds that you have deposited with no penalty or taxation. And you can do a rollover from your Roth. IRA reserve requirement may be up to 20% of the loan amount, to be available in the event of insufficient cash flow to pay operating expenses and mortgage. Yes, you can absolutely use your SDIRA to loan money to others. In fact, it's one of the only retirement accounts of its kind that enables investors to loan. IRS Tax Code and Using an IRA as Collateral The primary reason retirement account investors don't typically borrow cash (also called debt or leverage) to. If you were able to secure the loan with collateral or other assets, then this would allow you to keep any property that was used as collateral in addition to. Your IRA can issue a secured or unsecured promissory note. With a secured real estate note you will also create a mortgage or deed of trust. You will draft the. If your SDIRA purchases a property using a non-recourse loan, the debt financing transaction will subject the IRA to unrelated debt-financed income (UDFI). This is all to say that using IRA funds to buy a car -- unless you're already retired -- is not the best idea. Borrowing rules. Q: Can I borrow from my IRA for. IRAs and IRA-based plans (SEP, SIMPLE IRA and SARSEP plans) cannot offer participant loans. A loan from an IRA or IRA-based plan would result in a prohibited. The loan is secured by collateral which equals % of the outstanding loan balance and is held in the TIAA Traditional Annuity; The interest rate is variable.

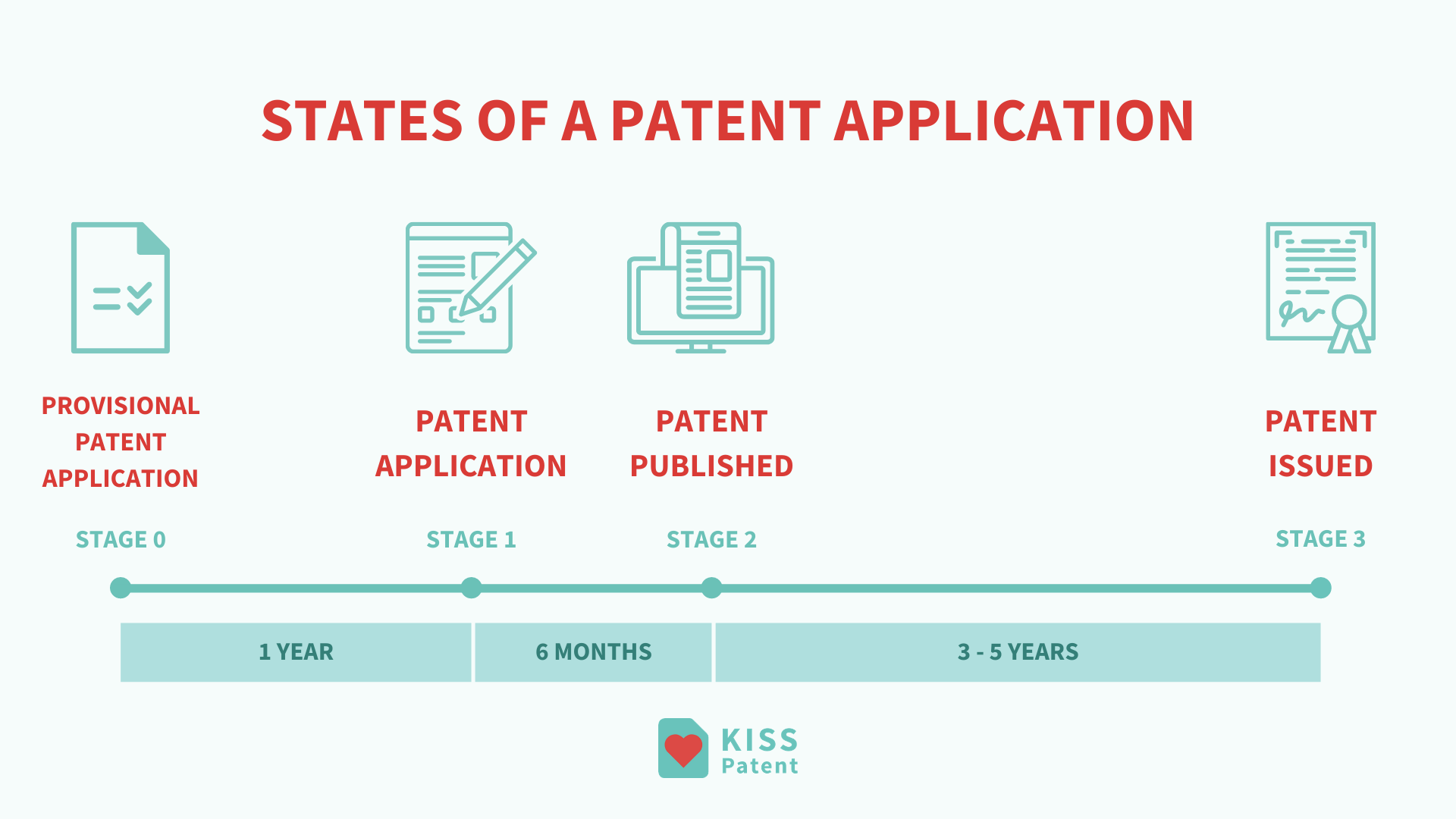

What Does It Mean When A Patent Is Pending

But colloquially, figure that patent pending means that a patent application was filed, but a patent has not yet been issued. It may never be. A filing of a patent application does not mean you have a patent Worldwide patent pending does not exist. However, the closest analog. A “pending patent” is the term used to describe a patent application that has been filed with the patent office, but has yet to be granted. patent approval. The "patent pending" label identifies such a product The PPA isn't examined by the USPTO, so it does not indicate that the invention is. 'Patent pending'. You can add that you have a 'UK patent pending' or 'UK patent applied for' on your invention itself, or on your packaging or marketing. Since marking a new product “Patent Pending” reinforces the claim that the product is “new”; and communicates to potential customers that the product includes. In short, patent pending means that a patent application has been filed with the United States Patent and Trademark Office (USPTO) but has not yet been issued. A pending patent application is one that has been filed in the US Patent & Trademark Office but has not reached completion of the prosecution process. So, patent-pending inventors/owners are protected in the sense that they can disclose their invention without hurting their ability to get a patent. Also. But colloquially, figure that patent pending means that a patent application was filed, but a patent has not yet been issued. It may never be. A filing of a patent application does not mean you have a patent Worldwide patent pending does not exist. However, the closest analog. A “pending patent” is the term used to describe a patent application that has been filed with the patent office, but has yet to be granted. patent approval. The "patent pending" label identifies such a product The PPA isn't examined by the USPTO, so it does not indicate that the invention is. 'Patent pending'. You can add that you have a 'UK patent pending' or 'UK patent applied for' on your invention itself, or on your packaging or marketing. Since marking a new product “Patent Pending” reinforces the claim that the product is “new”; and communicates to potential customers that the product includes. In short, patent pending means that a patent application has been filed with the United States Patent and Trademark Office (USPTO) but has not yet been issued. A pending patent application is one that has been filed in the US Patent & Trademark Office but has not reached completion of the prosecution process. So, patent-pending inventors/owners are protected in the sense that they can disclose their invention without hurting their ability to get a patent. Also.

A patent pending notice lets potential competitors know that they could be liable for such damages if they proceed to copy your invention, even though it is not. “Patent pending” or “patent applied for” may be used for any kind of patentable process or product to indicate that a patent has been applied for but not yet. Definition. Patent Pending is a legal status indicating that a patent application has been filed with the patent office but has not yet been granted or rejected. A patent publication does not necessarily mean that the application matured into an issued patent. You may want to track the status of a pending application. When you see a product with "patent pending" label, it means a patent application has been filed but not get granted. You can think of the ". "Patent Pending" represents the pursuit of new, better, different – even when that path is more difficult (or takes longer). We've found that you, our Community. While a pending patent application does not give any rights to exclude others from making your invention, a pending application may deter a competitor from. What does Patent Pending mean? It means that there is a patent application pending approval. Done Again – one liner! Whew that's it! We're. “Patent pending” occurs when a patent application is filed and pending at the U.S. Patent Office. In other words, you need to have filed the patent application. 'Patent pending' means a patent has been applied for. 'Patent pending' and similar markings serve to put would-be imitators on notice of the patent application. A patent pending refers to the pending claim under the patent application following the instructions of the Patent and Trademark Office (USPTO). “Patent pending” means that you have filed a patent application which covers your invention. Filing a provisional patent application, a utility patent. The phrase “patent pending” may be used in relation to an invention from the date that a patent application disclosing that invention is submitted to the patent. However, you should remember that the application by itself does not confer any legal protection. You will only be able to challenge patent infringements if the. The term “patent pending” denotes a temporary status granted to a product or process in the preliminary stages of a full patent application. Patent pending is the term used to describe a patent application that has been filed with the patent office, but has not issued as a patent. patent approval. The "patent pending" label identifies such a product The PPA isn't examined by the USPTO, so it does not indicate that the invention is. While a pending patent application does not give any rights to exclude others from making your invention, a pending application may deter a competitor from. Patent pending is the term used to describe a patent application that has been filed with the patent office, but has not issued as a patent. A patent gives you the exclusive rights to exclude others from copying, using, importing, and selling a patented innovation.

How Much Debt To Qualify For Chapter 7

The short answer to this question is “no, there is no minimum amount of debt necessary to qualify for bankruptcy.” However, for Chapter 7 bankruptcy cases. Many debtors who file for Chapter 7 bankruptcy are pleased to learn that they can keep some of their personal property. If you owe money on a secured debt. This post will be able to help you decide in minutes whether you're eligible. There is no minimum debt amount required to qualify for filing bankruptcy. Much of the credit card debt reported by the outliers was clearly incurred to subsidize the operation of a money- losing business. OUTLIERS BY STATE: Debtors. Philadelphia bankruptcy, credit report, and debt collection abuse attorney. Are you concerned you earn too much money to file Chapter 7 bankruptcy? If your total monthly income over the course of the next 60 months is less than $7, then you pass the means test and you may file a Chapter 7 bankruptcy. If. Chapter 7 bankruptcy covers or "discharges" credit card balances, medical bills, past-due rent payments, payday loans, overdue cellphone and utility bills. Disabled veterans filing to eliminate debt gained while on active military duty · Wages, salary, tips, bonuses, overtime, and commissions · The filer violated a. If the debtor's disposable income, projected for a five-year period, is more than 25 percent of the total unsecured debt, the debtor will likely be denied a. The short answer to this question is “no, there is no minimum amount of debt necessary to qualify for bankruptcy.” However, for Chapter 7 bankruptcy cases. Many debtors who file for Chapter 7 bankruptcy are pleased to learn that they can keep some of their personal property. If you owe money on a secured debt. This post will be able to help you decide in minutes whether you're eligible. There is no minimum debt amount required to qualify for filing bankruptcy. Much of the credit card debt reported by the outliers was clearly incurred to subsidize the operation of a money- losing business. OUTLIERS BY STATE: Debtors. Philadelphia bankruptcy, credit report, and debt collection abuse attorney. Are you concerned you earn too much money to file Chapter 7 bankruptcy? If your total monthly income over the course of the next 60 months is less than $7, then you pass the means test and you may file a Chapter 7 bankruptcy. If. Chapter 7 bankruptcy covers or "discharges" credit card balances, medical bills, past-due rent payments, payday loans, overdue cellphone and utility bills. Disabled veterans filing to eliminate debt gained while on active military duty · Wages, salary, tips, bonuses, overtime, and commissions · The filer violated a. If the debtor's disposable income, projected for a five-year period, is more than 25 percent of the total unsecured debt, the debtor will likely be denied a.

How Much Debt Do I Need to File for Bankruptcy? There is no minimum level of debt needed to file for bankruptcy. However, given the impact it can have on. Pass a “means test”: This will determine whether you are eligible to file for Chapter 7 bankruptcy. If your income is below the median income in your state, you. The Chapter 7 bankruptcy means test determines whether or not you make too much money to file for consumer bankruptcy. Most, but not all, who file for Chapter 7 bankruptcy protection must pass the means test to qualify. much debt as possible. This step, known as liquidation. How Much Debt You Should Have in Chapter 7 Bankruptcy. Most attorneys won't accept a Chapter 7 bankruptcy client with less than $10, in dischargeable debt. To be eligible to file for bankruptcy under Chapter 7, you must satisfy the Means Test. The easiest way to qualify for Chapter 7 is to have an income below the. While there is no federal minimum debt requirement for filing bankruptcy, the unofficial guidance is that it may not be worth it to file if your debts are less. Chapter 7 bankruptcy is available to certain individuals who cannot pay their debts, such as credit card debt and past-due medical bills. If you qualify for. To qualify for a Chapter 7 Bankruptcy, you must first pass the “Means Test,” which requires that your income not exceed a certain amount. For instance, Chapter 7 bankruptcy covers or "discharges" credit card balances, medical bills, past-due rent payments, payday loans, overdue cellphone and. In the United States the law does not require a minimum amount of debt to file bankruptcy. The need to file bankruptcy is relative to the. Your unsecured debts total more than half your annual income. It would take five years (or more) to pay off your debt, even if you took extreme measures. Your. There is no strict answer, because Ohio bankruptcy laws don't require a certain minimum debt amount to be eligible for bankruptcy. While your debt amount is a. About Bankruptcy Filing bankruptcy can help a person by discarding debt or making a plan to repay debts. A bankruptcy case normally begins when the debtor. You can earn significant monthly income and qualify for Chapter 7 bankruptcy if you have a large family or considerable but reasonable expenses. In Chapter 7 bankruptcy, also known as liquidation or straight bankruptcy, you can ask a court to discharge the majority of your debts so that you can start. This test compares your income to the state's median and considers your disposable income. Qualifying for the means test allows you to eliminate most debts. Chapter 7 bankruptcy will discharge most of your debts from credit cards, medical bills, personal loans, personal loans, and certain personal income taxes. Chapter 7 provides relief to debtors regardless of the amount of debts owed or whether a debtor is solvent or insolvent. A Chapter 7 Trustee is appointed to.

Extreme Couponing 2021

The show profiled four extreme couponers and their quest to spend almost nothing at the grocery store. Each couponer had stockpiles that took up entire rooms. Extreme couponing: learn how to be a savvy shopper and save money-- one · Spencer, Kathy. How to shop for free: shopping secrets for smart. I feel like extreme couponing as seen on tv, etc. is primarily in the US, and isn't possible in Canada as the deals just aren't that great in comparison. This is a MUST for any EXTREME Couponer. It has all the weekly sales for popular grocery stores and drug stores in your area. Whenever and wherever you are. Extreme couponing is a great way to maximize your savings while you grocery shop without sacrificing quality in what you buy. How do extreme couponers get their coupons? Extreme couponers primarily get "Coupon Statistics: Usage Behavior Shifts to " Share This. Extreme couponing is a thing of the past. The show killed it HARD. It exposed a lot of fraud and loopholes in the system that manufacturers and. A guide to extreme couponing in the modern age and how to use your More Episodes. NBCUniversal Media LLC, all rights reserved. Top Podcasts. Check out our extreme couponing selection for the very best in unique or custom, handmade pieces from our shops. The show profiled four extreme couponers and their quest to spend almost nothing at the grocery store. Each couponer had stockpiles that took up entire rooms. Extreme couponing: learn how to be a savvy shopper and save money-- one · Spencer, Kathy. How to shop for free: shopping secrets for smart. I feel like extreme couponing as seen on tv, etc. is primarily in the US, and isn't possible in Canada as the deals just aren't that great in comparison. This is a MUST for any EXTREME Couponer. It has all the weekly sales for popular grocery stores and drug stores in your area. Whenever and wherever you are. Extreme couponing is a great way to maximize your savings while you grocery shop without sacrificing quality in what you buy. How do extreme couponers get their coupons? Extreme couponers primarily get "Coupon Statistics: Usage Behavior Shifts to " Share This. Extreme couponing is a thing of the past. The show killed it HARD. It exposed a lot of fraud and loopholes in the system that manufacturers and. A guide to extreme couponing in the modern age and how to use your More Episodes. NBCUniversal Media LLC, all rights reserved. Top Podcasts. Check out our extreme couponing selection for the very best in unique or custom, handmade pieces from our shops.

Start Extreme Couponing: Learn To Coupon The Clever Way & Stretch Every 14 ). Language, English. Paperback, 43 pages. ISBN, Item. “Extreme Couponing” is a show on TLC that follows the exploits of self-proclaimed “extreme couponers” and the over-the-top tactics they use to gather as. We are currently scheduling workshops for If you are interested in having a workshop in your area, email [email protected] Check back soon for. Published: PM CST November 23, Updated: PM CST November 23, SAN ANTONIO — We've all seen extreme couponers, and while they can save. New series 'Extreme Couponing' is based on the one-hour special that aired in December Each episode introduces viewers to America's most extreme 'super. Back in April after the first episode of TLC's “Extreme Couponing” aired, there was a massive uproar from the couponing community all over the web. Basically, J. EXTREME COUPONING CANADA. . Join group. About this group. Everyone wants Nov 11, . I have a question for the admin. Are gift cards allowed to. What Students Can Learn From 'Extreme Couponing' · 1. Look for stores with the best deals. · 2. Get coupons. · 3. Keep your coupons organized. · 4. Make a list. 7 Tips for Building a Couponing Stockpile in · Patrones Amigurumi · Bricolage · Amigurumi ; How to Coupon at CVS for Beginners | Learn How to Shop For Free |. Extreme Coupon Couponing Funny Shirt Unique Gift Shirts Tee Graphic T-Shirts. CA$ Add to Favourites. COUPONING IN ! | How Have Things Changed? Jenn Least · I Bought EVERYTHING With A COUPON! | Extreme Couponing in Canada. Jenn Least. My best friend has started to do what society calls “extreme couponing” I understand the need for couponing and saving money but does extreme couponing. Bargain shoppers who go to extremes to find great deals are profiled. Director. 2 Credits. Nicole Zaremba. 40 Episodes · Nicole Zeremba. Don't forget to load your cashback or print your coupon from Unilever 12 Days Saving today!! ▶️ Watch this reel. Saving Money: How To Become An Extreme Coupon Pro ; Saving Money · How To Become An Extreme Coupon Pro ; FREE delivery Thursday, August 1 on your first order. Puryear defines herself as an “extreme couponer,” or someone who clips and uses coupons to get huge discounts on food. Some extreme couponers do it to feed. Yes, extreme couponing, in which people save a huge percentage off their costs, is real. Everyday people have saved hundreds of dollars in grocery stores. For. Extreme couponing: learn how to be a savvy shopper and save money-- one · Spencer, Kathy. How to shop for free: shopping secrets for smart. Extreme Coupon Couponing Funny Shirt Unique Gift Shirts Tee Graphic T-Shirts. $ Add to Favorites.

5 Ways To Invest Your Money

investing on a very short-term view, can you get out straight away, or are there limited ways to sell and get your money? Do you know if other investors are. A savings account is the ideal spot for an emergency fund or cash you need within the next three to five years. Good for long-term goals. Investing can help you. 5 Ways to Invest Your Excess Funds · Mutual Funds · Online High-Yield Savings Accounts · Roth IRA · Peer-to-Peer Lending · (k) · Contact Us · Quick Links. Step 4: Your Investment options · Shares · Funds · Exchange Traded Funds (ETFs) · Investment Trusts · Bonds and Gilts. Charles Schwab offers investment products and services, including brokerage and retirement accounts, online trading and more. Mutual funds offer you the advantage of investing indirectly into stock markets through the expertise of professional managers. Being busy with your job. 1. Build an emergency fund · 2. Pay down debt · 3. Put it in a retirement plan · 4. Open a certificate of deposit (CD) · 5. Invest in money market funds · 6. Buy. Understand your investing options · Stocks: Stocks are shares of a company. · Bonds: Bonds are like IOUs for loans that the investor makes to the borrower. 1. TAKE RESPONSIBILITY FOR YOUR OWN LIFE. · 2. SET S.M.A.R.T. GOALS. · 3. LEARN HOW MONEY WORK. · 4. TAKE CARE OF YOUR PHYSICAL HEALTH. · 5. TAKE CARE OF YOUR. investing on a very short-term view, can you get out straight away, or are there limited ways to sell and get your money? Do you know if other investors are. A savings account is the ideal spot for an emergency fund or cash you need within the next three to five years. Good for long-term goals. Investing can help you. 5 Ways to Invest Your Excess Funds · Mutual Funds · Online High-Yield Savings Accounts · Roth IRA · Peer-to-Peer Lending · (k) · Contact Us · Quick Links. Step 4: Your Investment options · Shares · Funds · Exchange Traded Funds (ETFs) · Investment Trusts · Bonds and Gilts. Charles Schwab offers investment products and services, including brokerage and retirement accounts, online trading and more. Mutual funds offer you the advantage of investing indirectly into stock markets through the expertise of professional managers. Being busy with your job. 1. Build an emergency fund · 2. Pay down debt · 3. Put it in a retirement plan · 4. Open a certificate of deposit (CD) · 5. Invest in money market funds · 6. Buy. Understand your investing options · Stocks: Stocks are shares of a company. · Bonds: Bonds are like IOUs for loans that the investor makes to the borrower. 1. TAKE RESPONSIBILITY FOR YOUR OWN LIFE. · 2. SET S.M.A.R.T. GOALS. · 3. LEARN HOW MONEY WORK. · 4. TAKE CARE OF YOUR PHYSICAL HEALTH. · 5. TAKE CARE OF YOUR.

Federally Insured Deposits at Banks and Credit Unions -- · Lifecycle Funds -- · Keep Your Money Working -- · Stick with Your Plan: Buy Low, Sell High. Start with safer investments, such as bonds, mutual funds, and retirement accounts, while you're still learning the market. Actions You Can Take · Start saving, form a savings habit, and pay yourself first! · Open and keep an account at a bank or credit union that meets your needs. If you're confident your child will manage their money well, a Junior ISA could be a good option. But if you're worried that they'll go on a savings splurge the. Investing small amounts of money on an ongoing basis can help smooth out returns over time and reduce overall portfolio volatility. Your monthly savings can. Plus, investing small amounts frequently can really add up over time. With mutual funds and ETFs, you can have diversification even when investing small amounts. In this article, we'll show you 5 simple steps to create a personalized investing plan that can generate the savings you need to enjoy your golden years. From stocks and bonds to real estate and alternative investments, we would cover all the bases and help you make informed decisions about where to put your. Be sure to always read an investment's prospectus or disclosure statement carefully. If you can't understand the investment and how it will help you make money. investing on a very short-term view, can you get out straight away, or are there limited ways to sell and get your money? Do you know if other investors are. Savings Accounts. If you have money in a savings account, you receive interest on the account balance, and you can easily get your money whenever you want it. Long-term (10+ years): Retirement savings. Invest in potentially higher-growth options like stocks and index funds. 2. Know Your Risk Tolerance. Jumpstart Your Investment Education Free, Day Mini-Course · The first steps of the Rule #1 investing strategy · Easy and quick investing tips. While money doesn't grow on trees, it can grow when you save and invest wisely. Knowing how to secure your financial well-being is one. Do You Want To Generate Passive Income & Make Your Money Work For You? Here's How To Start Investing In The Stock Market & Achieve Financial Freedom! Do you. Investing in yourself means actively working towards your personal growth and well-being. This could mean learning new things, honing your skills, or just. 5+ years index funds. It's great that you're thinking about your financial future and looking for ways to invest and pay off your student. Decide how you'll invest · Buy and sell investments yourself · Use a professional investment manager · Investing with a financial adviser · Invest through your. If you know you are going to need your money in three to five years, consider investing it in the stock market — but more conservatively. “You want to keep. Start with safer investments, such as bonds, mutual funds, and retirement accounts, while you're still learning the market.

What Is Bull Bear Market

A bull market indicates a sustained increase in price, whereas a bear market denotes sustained periods of downward trending stock prices – typically 20% or more. Investors are often categorised as bulls and bears. A “bull” by definition is an investor who buys shares because they believe the market is going to rise;. A bull market occurs when securities are on the rise while a bear market happens when securities fall for a sustained period of time. When you understand the. “Bear market” and “bull market” are terms used to explain price trends. Bull markets are periods in which the underlying price move is upwards. Bear markets are defined as a period of time when stock prices fall, typically by 20% or more, and investor sentiment is negative. Into the Wild · A bull market is a time when stocks are generally rising, and the economy is doing well. · A bear market is a period when stocks are generally. A new bull market begins when the closing price gains 20% from its low. Stocks lose 35% on average in a bear market.1 By contrast, stocks gain % on average. Under a mutually exclusive definition of the 4 market environments, Bear Markets account for 17% of market history, Bull Markets 24%, Wolf Markets 22%, and. A bull market is occurring when the economy is expanding and the stock market is gaining value, while a bear market is in effect when the economy is shrinking. A bull market indicates a sustained increase in price, whereas a bear market denotes sustained periods of downward trending stock prices – typically 20% or more. Investors are often categorised as bulls and bears. A “bull” by definition is an investor who buys shares because they believe the market is going to rise;. A bull market occurs when securities are on the rise while a bear market happens when securities fall for a sustained period of time. When you understand the. “Bear market” and “bull market” are terms used to explain price trends. Bull markets are periods in which the underlying price move is upwards. Bear markets are defined as a period of time when stock prices fall, typically by 20% or more, and investor sentiment is negative. Into the Wild · A bull market is a time when stocks are generally rising, and the economy is doing well. · A bear market is a period when stocks are generally. A new bull market begins when the closing price gains 20% from its low. Stocks lose 35% on average in a bear market.1 By contrast, stocks gain % on average. Under a mutually exclusive definition of the 4 market environments, Bear Markets account for 17% of market history, Bull Markets 24%, Wolf Markets 22%, and. A bull market is occurring when the economy is expanding and the stock market is gaining value, while a bear market is in effect when the economy is shrinking.

A bull market is typically defined as a period of high investor optimism when stock prices rise 20% or more from a previous low. What is a bull and bear market? A lens to analyze, understand, and predict potential outcomes of the financial market is defined by two perspectives: a bull. Stock prices rise in a bull market and fall in a bear market. Under bullish conditions, the stock market consistently gains value, despite some brief market. A bear market occurs when prices drop by 20% or more from recent highs, while a bull market occurs when prices rise by 20% or more from recent lows. A bull market is an “up,” market, with stocks charging forward, and earning money. Technically speaking, we're officially in a “bull” market once stock prices. Key Takeaways Bull and bear markets are common terms among investors. A bull market indicates optimism and growth, while a bear market reflects pessimism. Bull vs bear markets refer to how the stock market is trending. In general, a bull market is a sustained period of stock prices rising, while a bear market. A bear market is one in which prices are heading down and a bull market is used to describe conditions in which prices are rising. A bull market might begin when prices are low, as a bear market is ending, but economic conditions are usually strong when a bull market gets going. To put it simply, a bull market is a rising market, while a bear market is a declining one. Because markets often experience day-to-day (or even moment-to-. A “bull market” likely gets its name from the upward motion of a bull's attack. During a bull market, equity (stock) prices are on the rise. Key Takeaways Bull and bear markets are common terms among investors. A bull market indicates optimism and growth, while a bear market reflects pessimism. Bull markets are movements in the stock market in which prices are rising and the consensus is that prices will continue moving upward. Bear markets are the. A bull is someone who buys securities or commodities in the expectation of a price rise, or someone whose actions make such a price rise happen. In a bull market, prices are rising and investors expect that to continue. In a bear market, prices fall for an extended time and are expected to continue. Because bull markets tend to follow bear markets, stock prices are usually depressed at the start of a bull market. The dearth of investment capital creates an. Like the stock market, the crypto market is divided into two types: the market is upward or better known as the Bull Market and the downward market. The S&P Index is an unmanaged index of stocks used to measure large-cap U.S. stock market performance. Investors cannot invest directly in an index. A bull market is characterized by a sustained increase in stock prices, typically by at least 20% from the last downturn.

Where Can I Use An Atm For Free

Use a MoneyPass ATM to avoid surcharge-fees when you withdraw money. · mediacomponent.ru · YOUR CARD · YOUR TOOLS · CALIFORNIA RESIDENTS · SOCIAL. undefinedGet the facts on using ATMs abroad. Better value. MYTH: It's more ATM locations and get information about the many ways to use the card. Surcharge-free cash access. Allpoint gives you freedom to get your cash how you want, without ATM surcharge fees, at over 55, conveniently-located ATMs. Need cash? No problem. Get access to thousands of fee-free ATMs near you to withdraw money on the go. Credit Union West Members now have FREE access to over Allpoint ATMs worldwide. Whether you're at home, work, or traveling, get your cash without ATM. Use the link below to find a surcharge-free ATM convenient to you! There are over a thousand surcharge free ATM's in the Maryland-Virginia-DC region alone! You can access your Capital One checking account at any ATM, but to avoid fees, find and use a fee-free Capital One, MoneyPass® or Allpoint® ATM. You have. Access your money from any ATM that accepts Visa® or American Express® Cards. barcode reload. Free. As a proud member of the Allpoint Network, we can provide access to over 55, surcharge-free ATMs at your favorite local retail locations including Target. Use a MoneyPass ATM to avoid surcharge-fees when you withdraw money. · mediacomponent.ru · YOUR CARD · YOUR TOOLS · CALIFORNIA RESIDENTS · SOCIAL. undefinedGet the facts on using ATMs abroad. Better value. MYTH: It's more ATM locations and get information about the many ways to use the card. Surcharge-free cash access. Allpoint gives you freedom to get your cash how you want, without ATM surcharge fees, at over 55, conveniently-located ATMs. Need cash? No problem. Get access to thousands of fee-free ATMs near you to withdraw money on the go. Credit Union West Members now have FREE access to over Allpoint ATMs worldwide. Whether you're at home, work, or traveling, get your cash without ATM. Use the link below to find a surcharge-free ATM convenient to you! There are over a thousand surcharge free ATM's in the Maryland-Virginia-DC region alone! You can access your Capital One checking account at any ATM, but to avoid fees, find and use a fee-free Capital One, MoneyPass® or Allpoint® ATM. You have. Access your money from any ATM that accepts Visa® or American Express® Cards. barcode reload. Free. As a proud member of the Allpoint Network, we can provide access to over 55, surcharge-free ATMs at your favorite local retail locations including Target.

Associated Bank and MoneyPass® ATM use is free for Associated Bank customers. · Check deposits made at an ATM may not be made available for immediate withdrawal. Free Coin Counting Machine · Quest Atm · Small Business Banking · Credit Unions use them again for anything. This happened at a CITI ATM at a They. When looking for a surcharge-free ATM, watch for the CU$, CO-OP, Allpoint, Money Pass, and CU Here logos. · Use our Locator to find a list of surcharge-free ATMs. Access over 55, surcharge-free ATMs worldwide through the Allpoint Network. Just look for the Allpoint logo or use the map below to find an ATM near you! Discover surcharge free ATMs with Wisely by ADP. Access tens of thousands of surcharge-free ATMs nationwide and enjoy convenient, fee-free withdrawals. Need cash? No problem. Get access to thousands of fee-free ATMs near you to withdraw money on the go. Not only that, but Axos places no monthly limit on how much can be refunded, offering you unlimited free ATM transactions throughout the U.S.. Axos' Rewards. Find a MoneyPass® ATM. Use your MoneyPass ATM card at any of the ATMs listed on this site without paying a surcharge. Access your money from any ATM that accepts Visa® debit cards. women in blue shirt smiling. Ask your financial institution if they are part of the TransFund ATM Pledge Group. If they are, then you can enjoy access to TransFund ATMs with no surcharge! Use your Porte® Visa® debit card to withdraw cash at fee-free ATMs by MoneyPass®1 conveniently located at more than 40, locations nationwide. Plus, find in-. PeoplesBank partners with Allpoint® to provide customers with fee-free access to their cash at over ATMs worldwide. Find a free ATM near you. Surcharge-free ATM service nationwide via the Allpoint® network · 43,+ Allpoint ATMs worldwide: Find locations quickly online; Includes ATMs in popular. Look for Fee-Free Options: Some banks and credit unions offer fee-free ATM access through partnerships with other financial institutions. Use your Branch App to find free* ATMs and ways to get rewarded—plus switch your direct deposit to Branch so getting paid is easier than ever. Direct Express® cardholders can get cash from ATMs worldwide wherever the MasterCard® acceptance mark is displayed. Some ATM owners apply a surcharge fee to use. undefinedGet the facts on using ATMs abroad. Better value. MYTH: It's more ATM locations and get information about the many ways to use the card. Access your money from any ATM that accepts Visa® debit cards. women in blue shirt smiling. You can use your Cash App Card at any ATM for a $ fee, plus any out-of-network fees charged by the ATM operator. Cash App provides unlimited free. AllPoint™ free ATMs are in Target®, Vons®, CVS®, and Costco® and many major retail outlets. Use our mobile app as an ATM locator! One Nevada Credit Union.

Cost Of Moving A Household

The average cost for a local move ranges from about $ for a one bedroom apartment to $1, for a four-bedroom home. Moving companies determine their prices. For those venturing on a longer journey spanning 1, miles, the average expenses for a bedroom home can escalate to around $5, It's crucial to note. The answer will depend on the location and house type, but the average to move a house is about $12 to $16 per square foot. Moving a 2, square foot home. How much does it cost to move a four-bedroom house? cost guide · With DIY packing, full-service movers generally cost $9, to $19, · With packing. We created a simple table of very accurate moving prices for a local move in San Francisco. It's based on home size and size of inventory. Your home's size can impact a cross-country move's overall costs, whether you use a moving container, rent a truck, or hire professional movers. A one-bedroom. How Much Do Movers Cost? The cost of hiring a full-service moving company typically ranges from $ - $ Your final price depends on distance, size, and. There are a lot of costs to be factored in with moving. What is the distance from your old home to your new home? Of course, a local move will be cheaper than a. Four-bedroom moves above 50 miles and up to miles have different prices ranging from $2, to $5, or more, based on the company you select. Moving. The average cost for a local move ranges from about $ for a one bedroom apartment to $1, for a four-bedroom home. Moving companies determine their prices. For those venturing on a longer journey spanning 1, miles, the average expenses for a bedroom home can escalate to around $5, It's crucial to note. The answer will depend on the location and house type, but the average to move a house is about $12 to $16 per square foot. Moving a 2, square foot home. How much does it cost to move a four-bedroom house? cost guide · With DIY packing, full-service movers generally cost $9, to $19, · With packing. We created a simple table of very accurate moving prices for a local move in San Francisco. It's based on home size and size of inventory. Your home's size can impact a cross-country move's overall costs, whether you use a moving container, rent a truck, or hire professional movers. A one-bedroom. How Much Do Movers Cost? The cost of hiring a full-service moving company typically ranges from $ - $ Your final price depends on distance, size, and. There are a lot of costs to be factored in with moving. What is the distance from your old home to your new home? Of course, a local move will be cheaper than a. Four-bedroom moves above 50 miles and up to miles have different prices ranging from $2, to $5, or more, based on the company you select. Moving.

How Much Do Movers Cost? The cost of hiring a full-service moving company typically ranges from $ - $ Your final price depends on distance, size, and. Generally, a local move costs $1, on average while a long-distance move of 1, miles costs $4, on average. These are the typical estimates based on a. Unless you clearly spell out the specification you require with a plan view and sectional view, you cannot precisely say the cost. However for a. Use our moving cost calculator to get an estimate of your move. Professional movers can vary in cost. Approximately $$ depending on the size of your. “On average, local moves can cost anywhere from $ to $2,, while long-distance moves can range from $2, to $5,, depending on the distance and amount. On average, a local move could cost you anywhere from $80 to $/ hour for two movers and a truck. The total cost can be based on the number of furnished. Unless you clearly spell out the specification you require with a plan view and sectional view, you cannot precisely say the cost. However for a. Four or more movers will cost between $ and $ per hour. Accessibility. Movers will also consider the degree of accessibility to the house or apartment. Long distance moving a two-bedroom house costs from $1, to $20,, depending on the type of move. Moving companies may offer intrastate, interstate, cross-. We've gathered moving quotes from nine long-distance movers and have found a price range of $4, to $12, Our Top Pick. Our Top Pick. Moving a three-bedroom home locally can cost between $ and $1, Long-distance moves can range from $3, to $7, Four-Bedroom Home And Larger. For. The average cost to hire movers in Alberta: 1-bedroom apartment: $; 2-bedroom apartment: $; 2 bedroom house: $; 3-bedroom house: $ The cost to move a 2, sq. ft. house anywhere in the nation will average between $2, and $9, The cost will depend on many factors such as the location. How big is your household? The volume of your items that you are moving ; Miami, Florida, 2+ Bedroom, $1, ; Miami, Florida, Large House, $1, ; Los Angeles. The best time to move is in the summer when the cost ranges from $ to $ per hour. Two movers are advised. Only one hour would be added to the total time. Average cost of local movers in Los Angeles · 1-bedroom: $ When moving out of a 1-bedroom home, using the services of a local moving company in L.A. should. The American Moving and Storage Association states that the average cost to move across state lines can be between $4, and $4,, with an average distance. How Much Does a Typical Ottawa Move Cost? · 1-bedroom house. $ – $ · 2-bedroom house. $ – $ · 3-bedroom house. $ – $ · 4-bedroom. Use our moving cost calculator to get an estimate of your move. Professional movers can vary in cost. Approximately $$ depending on the size of your.

Tips For Buying Gold Coins

This article strips away the complexity of purchasing gold, providing you with a clear path to acquiring gold bullion, coins, and bars. Our gold buying guide here at The Gold Bullion Company provides you with all of the advice you need for purchasing gold. Read our gold buying tips today! Opt for Universally Recognized Gold; Look For Reputable Dealers; Compare the Spot Price of Gold; Average into a Liquid Position; Buy With Cash Only — Never. Gold coins also often come with a higher price tag compared to the same amount of gold in bullion form. Some of the best gold coins on the market include the. Investors looking to choose between gold bars and gold coins should get all the fact on their investment. Gold Bars are often a great way to buy gold, they. Numismatic coins on the other hand are rare coins and are considered collectibles. Numismatic gold coin prices are more volatile than bullion coin prices. 1. Buy Physical Gold and Silver · 2. It Must Be Under Your Direct and Unencumbered Ownership · 3. Only the Most Liquid Gold Coins and Gold Bars · 4. Build Up. This guide is packed with must read information and advice on how to invest in gold coins and bars, including why buy gold, and where to buy gold. How to Buy Gold Coins? · Working with Local Coin Dealers · Ordering from TV Dealers · Visiting Coin Shows · Purchasing From a Bank · Online Marketplaces. The. This article strips away the complexity of purchasing gold, providing you with a clear path to acquiring gold bullion, coins, and bars. Our gold buying guide here at The Gold Bullion Company provides you with all of the advice you need for purchasing gold. Read our gold buying tips today! Opt for Universally Recognized Gold; Look For Reputable Dealers; Compare the Spot Price of Gold; Average into a Liquid Position; Buy With Cash Only — Never. Gold coins also often come with a higher price tag compared to the same amount of gold in bullion form. Some of the best gold coins on the market include the. Investors looking to choose between gold bars and gold coins should get all the fact on their investment. Gold Bars are often a great way to buy gold, they. Numismatic coins on the other hand are rare coins and are considered collectibles. Numismatic gold coin prices are more volatile than bullion coin prices. 1. Buy Physical Gold and Silver · 2. It Must Be Under Your Direct and Unencumbered Ownership · 3. Only the Most Liquid Gold Coins and Gold Bars · 4. Build Up. This guide is packed with must read information and advice on how to invest in gold coins and bars, including why buy gold, and where to buy gold. How to Buy Gold Coins? · Working with Local Coin Dealers · Ordering from TV Dealers · Visiting Coin Shows · Purchasing From a Bank · Online Marketplaces. The.

You can buy gold jewellery or you can buy gold bullion. While many women would initially choose to buy jewellery you should be aware that this is not the best. Investment-quality gold bars should be at least % () pure gold. · Aside from bars and coins, it is also possible to buy physical gold in the form of. Buy the right kind of gold coins. Invest in 1-ounce coins as they're easier to both buy and sell. Stick to well-known coins like the karat Canadian Maple. Choose the Right Seller: Look for reputable dealers who offer competitive prices. Compare prices among local coin shops, online dealers, and auction sites. How to Buy Gold Coins? · Working with Local Coin Dealers · Ordering from TV Dealers · Visiting Coin Shows · Purchasing From a Bank · Online Marketplaces. The. This guide is packed with must read information and advice on how to invest in gold coins and bars, including why buy gold, and where to buy gold. Investors who turn to gold bars are often looking, in parts, for a better value than they would maybe get with coins. The complexity of minting gold coins often. How to buy gold? There are various ways. These include investing in bullion through gold dealers (i.e., gold bars), mutual funds, futures, mining companies, and. value of your investment and the product premiums, how long you plan on holding your gold, how you will store it, taxation and how you plan on realising the. How to Buy Gold Coins? · Working with Local Coin Dealers · Ordering from TV Dealers · Visiting Coin Shows · Purchasing From a Bank · Online Marketplaces. Opt for Universally Recognized Gold; Look For Reputable Dealers; Compare the Spot Price of Gold; Average into a Liquid Position; Buy With Cash Only — Never. Choose reputable well-established dealers or banks to purchase gold coins. This ensures authenticity and reduces the risk of encountering fake. That said, larger bars lack flexibility in terms of changing the size of someone's holdings, or buying and selling - an advantage provided by buying gold coins. The underlying value of gold bullion coins is calculated by multiplying the coin's gold content by the current price of gold in the buyer's chosen currency. It is nearly impossible to buy Precious Metals for exactly what it is trading for on the stock market. This is because the London Bullion Market Association. Places to Buy Gold or Silver. The two most common places where you can purchase precious metals are from an online dealer, such as JM Bullion, or a local coin. When it comes to buying gold bullion, it is essential to do your research. World affairs and stock market activity often results in fluctuating gold prices, so. Buying Scrap Gold · Buying Gold Bullion · Buying Gold Futures · Buying Gold Exchange Traded Funds · About Investing in Gold. Gold coins are small, easily handled, and traded. They possess historical and numismatic value, making them collectible items. Gold bars, also known as bullion. How to Verify the Authenticity of Gold Bullion? · Check your gold coins thickness, diameter and weight against their published specifications. · Check the unique.